This guide will give you 7 high-overview steps of the core phases carried out during an MSP business exit and acquisition. Every business exit and sale are unique and follow their own path when it comes to the detail, but this guide can be used as a general outline to understand the core stages during M&A.

In some cases, MSP owners get offers direct that they are happy to proceed with which means the stages around going to market and generating interest are skipped. On the flip side, many business owners need to start at the beginning of the process to ensure they are fully prepared, drive maximum value and generate enough interest from potential acquirers.

When selling your MSP business preparation is key, educating yourself on the process is a must and ensuring you have the right partners in your corner will reap rewards when the time is right.

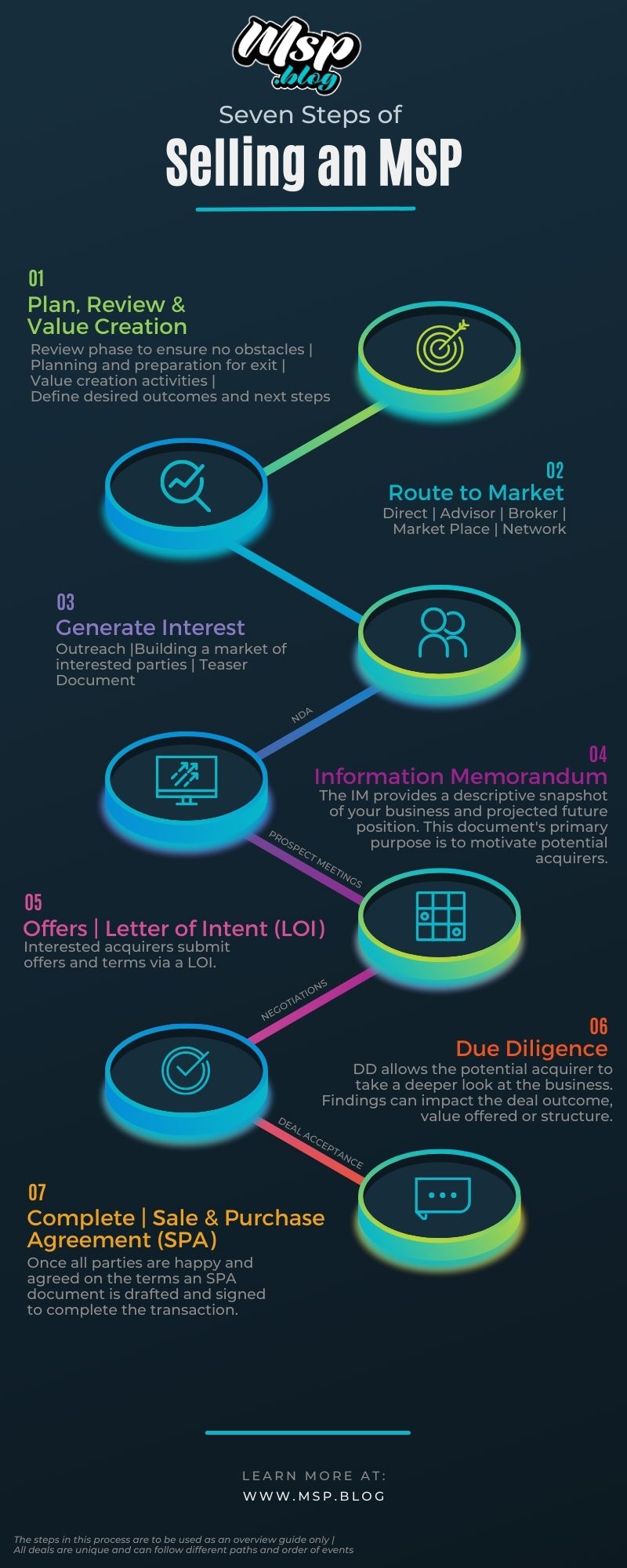

7 Steps to selling your MSP Business:

Plan, Review & Value Creation

The first stage in selling your business is making the decision to sell, and a plan around when you would like to exit and how the deal could be structured. At MSP.blog a lot of our content is around giving you the knowledge of how and when to plan for an eventual exit.

Having a clear time scale, ideal buyer and details at the start will not only improve the process but will add value to your business, as all actions you take within your business in your day to day will take this process into consideration. During the planning phase its also a must to include your ideal ‘what next’ plan. Once you have exited the business, what are you doing next? This is important as it allows you to emotionally disconnect from the process and gives you something to work towards. Often times, deals fall through because owners don’t have a clear plan of the process, what they want and what they are going to do next.

A key part of your exit plan is ‘valuation creation’ – Whether you’re working towards an exit in 1, 3 or 5+ years its important to plan out the activities that will be carried out to drive value creation and help increase your offers when you eventually go to market. Here are some great ways to increase the value of your MSP business.

Attention needs to be made around reviewing potential risks – ie any areas that could affect a future deal, impact the valuation or cause concerns. There can be many areas that could be a risk but pay special attention around finances, legals, key man dependence, customer contracts and teams. You can take the ‘exit ready’ scorecard to see where you need to improve to support your value creation and exit planning.

Route to Market

Once you have a clear plan around your timescales, desired outcomes and how to build value you need to review the best way to take your MSP business to market to create interest from potential acquirers.

There is no right or wrong way to this, and there are many options and variations. What works for some, wont work for others and vice versa.

Here are some common paths to take your MSP to market:

- Direct – Often there is a contact or someone you know that would make a great strategic acquirer.

- Network – Your network can often include valuable groups of businesses that may be interested in acquiring your business.

- Competition – Often competitors are interested in acquisitions as your business services and customers are closely aligned with theirs.

- Advisors / Brokers -Working with advisors and brokers that have M&A experience within the MSP space can help streamline the process and drive a marketplace of potential bidders.

- Market Place – Public marketplaces online can be a source to list and meet potential acquirers.

Generate Interest & Go to Market (GTM) | Teaser Document

When you have an audience to speak to about your MSP you need to drive demand. Depending on the route to market this will dictate whether you are doing the outreach, you have a broker raising the interest or you’re leveraging a marketplace for their audience.

Once the market and route has been decided you need to get this audience interested, excited, and intrigued – This is often done via a ‘Teaser’, which is often a 1–2-page document highlighting the plus points and key information about your MSP and the sale.

When doing direct ensure you have NDAs in place and are protected with the information you are sharing. If using a broker or marketplace, at this stage the teaser is often anonymous and company details only shared once they express interest and are under NDA.

Information Memorandum (IM)

When there are potential acquires that have expressed interest based on the teaser, been put under NDA and checked to see if they are quality candidate – An ‘IM’ document is shared to furnish the potential acquires with more detail to support the assessment of the MSP.

An ‘IM’ or information Memorandum within M&A is a short document that serves to provide potential buyers with essential information about the MSP for sale in a well-prepared format.

Offers | Letters of Intent (LOI)

After the ‘IM’ is issued, interested parties can submit questions, requests, or offers based on this stage. Offers at this stage are often in the form of an ‘LOI’ (Letter of Intent).

A ‘LOI’ within M&A is a written expression of potential buyers’ intent to enter into a transaction and a summary of the deal terms.

This phase can often follow many different paths, negotiations and back and forth.

When the MSP owner is happy with an offer and progressed by one of the potential acquirers they can accept subject to DD and the final agreement.

Due Diligence (DD)

Once a potential acquirer has been chosen, a data room is made available to the potential acquirer.

A data room or ‘virtual data room’ is a secure location (usually cloud based) that contains key information and documents about a company. The process of Due diligence will normally include reviewing all documents within the data room & in-depth Q&A.

DD allows the potential acquirer to take a deeper look at the business. Findings can impact the deal outcome, value offered or structure.

Based on the findings the potential acquirer may want to amend their offer and/or structure.

Complete | Sale and Purchase agreement (SPA)

When DD is complete and both parties are happy to progress, the end stage of an acquisition is often completed via an ‘SPA’ (Sale & Purchase Agreement).

An ‘SPA’ is a binding legal contract that obligates a buyer to buy and a seller to sell the business and outlines the details about the transactions, financials, all legal obligations, deal structure and earn out mechanics.

One the deal is complete it’s on to what you have planned next, and any earn out obligations. For the acquirer it’s time for them to integrate and grow the business.

Are you building an MSP business of value, that could be sold now or in the future?

Did you know 8 out of 10 businesses will not sell? More often than not, this is because they never developed an exit strategy.

Here at MSP Blog, we have developed a FREE ‘Exit Ready’ scorecard assessment to allow you to highlight focus areas for a plan, to support adding value and maximising a future exit (when you’re ready).

Find out where your IT business is at in 2 minutes, and get an instant report with actionable steps to help increase your value.